In the intricate world of wealth management, the concept of a Single Family Office (SFO) has emerged as a cornerstone for affluent families seeking a bespoke approach to managing their wealth and legacy. Understanding the key tasks of an SFO is essential to appreciate how these entities operate beyond traditional financial advisories, offering a more holistic and personalized service.

The Concept of a Single Family Office

A Single Family Office is a private organization that caters exclusively to the needs of an ultra-high-net-worth family. Unlike typical wealth management services, SFOs provide a broader spectrum of services, extending well beyond mere investment advice. Their primary goal is to manage and preserve the family’s wealth, ensuring its seamless transition through generations while aligning with the family’s values and goals.

Comprehensive Wealth Management

The foremost task of an SFO is to manage the family’s wealth. This includes developing and implementing investment strategies tailored to the family’s risk profile and financial goals. It’s not just about picking stocks or bonds; it’s about creating a diversified portfolio that can include real estate, private equity, and even alternative investments like art or venture capital.

Estate and Succession Planning

A crucial role of an SFO is to ensure the family’s wealth is passed on efficiently and in accordance with their wishes. This involves complex estate planning, creating trusts, and managing inheritances. The goal is to minimize taxes and legal hurdles while preserving wealth for future generations.

Tax Planning and Compliance

Navigating the labyrinth of tax laws is a significant task for SFOs. They must develop strategies to manage tax liabilities efficiently, ensuring compliance with the constantly changing tax regulations across different jurisdictions.

Philanthropic Endeavors

Many ultra-wealthy families are deeply involved in philanthropy. An SFO coordinates these charitable activities, aligning them with the family’s values and ensuring that donations are made in the most impactful way.

Risk Management

Risk management is a comprehensive task that includes not just financial risks but also risks to the family’s reputation, assets, and security. SFOs develop strategies to mitigate these risks, ensuring the family’s welfare and the safety of their assets.

Family Governance and Education

An often-overlooked role of SFOs is to promote family governance structures and educate younger family members about wealth management, responsibility, and the family’s values. This ensures a smooth transition of both wealth and knowledge through generations.

Lifestyle Management

For many SFOs, managing the family’s day-to-day affairs is part of the package. This can include anything from planning travel and managing properties to arranging exclusive experiences and maintaining privacy.

The Evolution of Single Family Offices

The role of SFOs has evolved significantly over time. Initially focused on financial and estate planning, they have now become more holistic, addressing the wider lifestyle and personal needs of wealthy families. This evolution reflects the growing complexity of managing vast wealth in an increasingly globalized world.

Adapting to Global Trends

SFOs must stay abreast of global economic trends, regulatory changes, and investment opportunities. They need to be agile, adapting their strategies to the shifting economic landscape while maintaining a long-term perspective.

Embracing Technology

The use of technology in managing investments, risk, and even in ensuring efficient operation of the family office is now a key task. From sophisticated financial software to cybersecurity measures, technology plays a critical role in the modern SFO.

Challenges and Considerations

While SFOs offer numerous benefits, they are not without challenges. The cost of running an SFO can be prohibitive, making it feasible only for the wealthiest families. The complexity of managing a wide range of services and the need for a high level of expertise can also pose significant challenges.

Regulatory Compliance

As financial regulations become more complex, ensuring compliance is a growing challenge for SFOs. This is particularly true for families with assets and interests spread across multiple jurisdictions.

Privacy and Security

For ultra-wealthy families, privacy and security are of paramount importance. SFOs must ensure that both physical and digital aspects of the family’s life are secure, which can be a challenging task in an age of global connectivity.

Conclusion

Single Family Offices represent the pinnacle of personalized wealth management services. By managing investments, ensuring efficient estate transition, and addressing the broader lifestyle needs of affluent families, SFOs play a crucial role in preserving and enhancing the legacies of the ultra-wealthy. As the world becomes more interconnected and the landscape of wealth management evolves, the importance and complexity of the tasks handled by SFOs will undoubtedly increase, making them an indispensable asset for wealthy families.

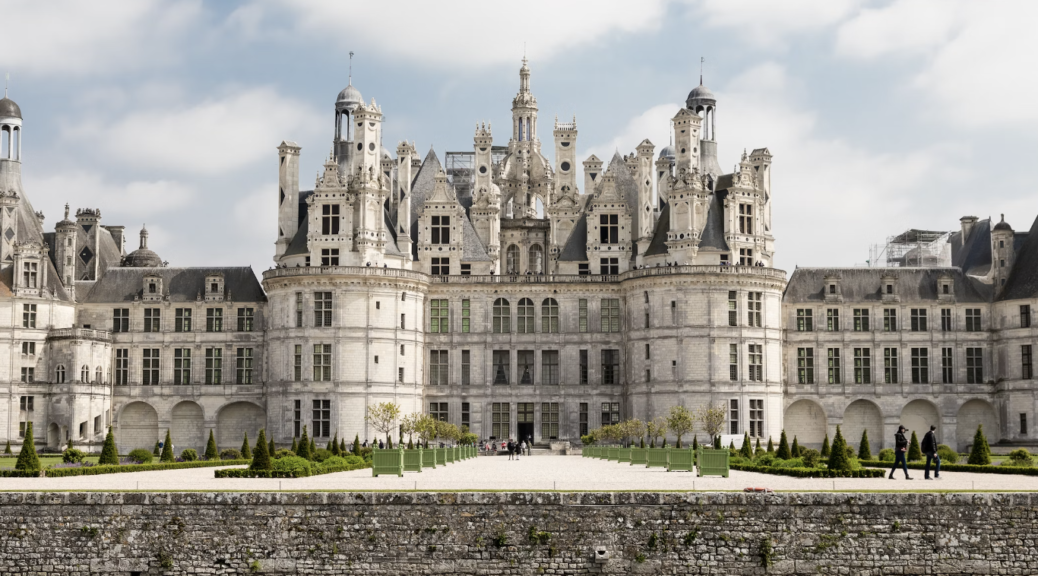

Picture Source: Dorian Mongel